THE CRYPTOCURRENCY market is volatile, and while it’s impossible to predict the future movements of crypto assets, indicators like the Fear and Greed Index can give insights.

But what actually is the Fear and Greed index and is it reliable?

What is the cryptocurrency Fear and Greed index?

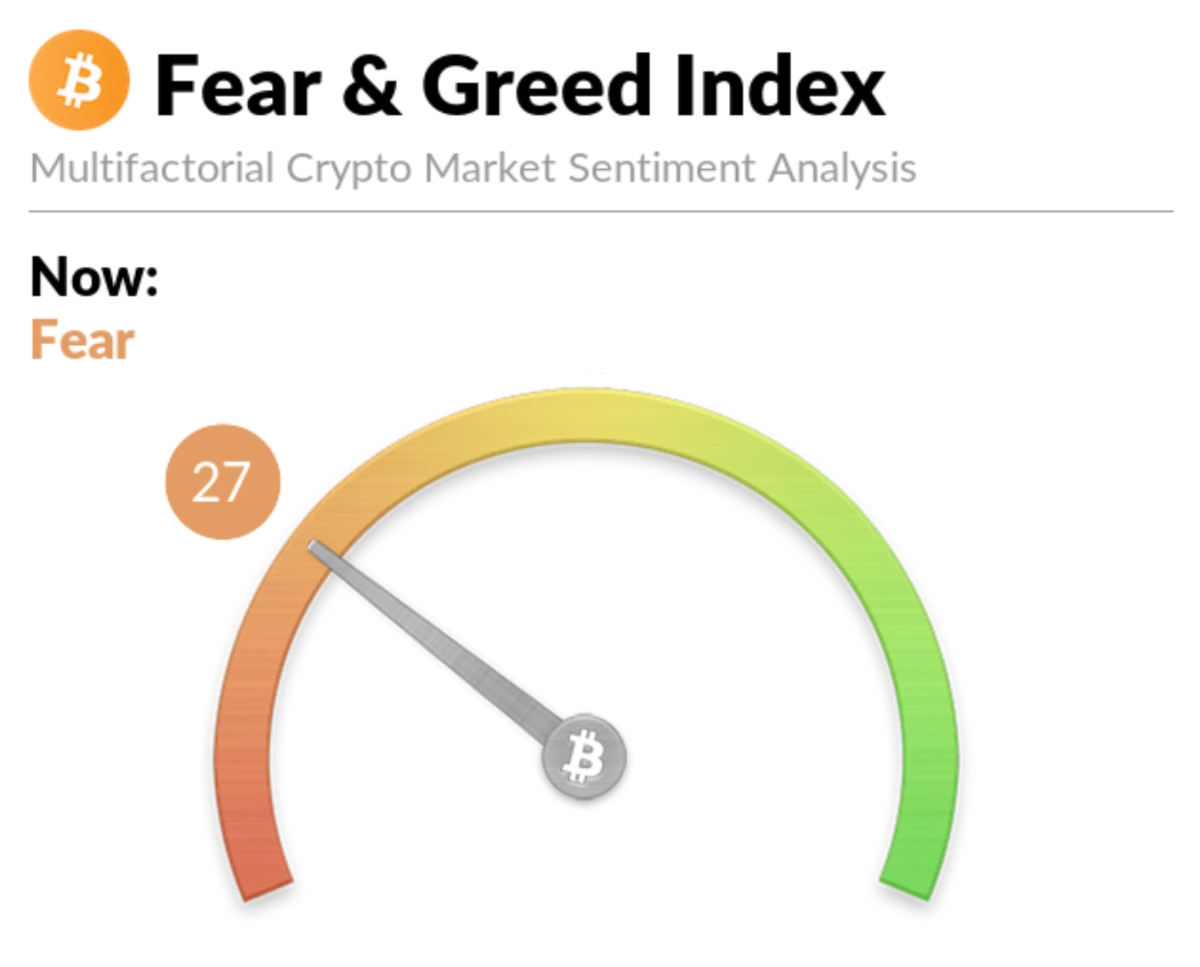

The Fear and Greed index generates a number between 1 and 100, with 1 showing the cryptocurrency market is in a state of extreme fear (meaning people are selling) while 100 indicates the market is in a state of extreme greed (meaning people are buying).

When the index is lower, this usually means it’s a good opportunity to buy.

As billionaire investor Warren Buffett once said, “buy when there’s blood in the streets.”

While if the index is higher it would generally be interpreted as a signal to sell as when prices rise quickly, there’s a chance they’ll fall sharply.

In simple terms, when the Fear and Greed Index value is low, this signals the price will generally increase, and when the index value is high, this indicates the price will usually decrease.

How is the Fear and Greed Index calculated?

Volatility (25%)

The index compares volatility and max drawdowns (a drawdown is a decline in value) against the 30-day and 90-day average volatility and drawdown numbers.

High volatility is considered fearful.

Volatility accounts for 25 per cent of the index value.

Momentum and volume (25%)

The index measures the current momentum and volume of the cryptocurrency market.

Also against the 30-day and 90-day averages.

High volume and momentum are seen as negatives and increase the final output.

Momentum and volume represents 25 per cent of the index value.

Social media (15%)

The index also follows mentions and hashtags for Bitcoin and compares them to historical averages.

More mentions and hashtags are seen as an increase in market involvement.

Social media represents 15 per cent of the index value.

Surveys (15%)

The index conducts market-wide surveys weekly with between 2,000-3,000 participants.

Surveys represent 15 per cent of the index value.

Trends (10%)

The index includes Google Trends date.

The higher the search interest for cryptocurrency, the more greed is seen in the market.

Google Trends represents 10 per cent of the index value.

Dominance (10%)

The index measures Bitcoin’s dominance in the overall cryptocurrency market.

The higher the Bitcoin dominance, the more fearful the market.

Dominance accounts for 10 per cent of the index value.

Is the Fear and Greed Index reliable?

LookIntoBitcoin has tracked the Crypto Fear and Greed Index against the price of Bitcoin since 2018 and the price and index value appears to correlate.

Follow 24/7 Crypto on Twitter for the latest news and developments as they happen