THE FIRST Insurance firm is setting up shop in the metaverse, offering risk protection for NFTs.

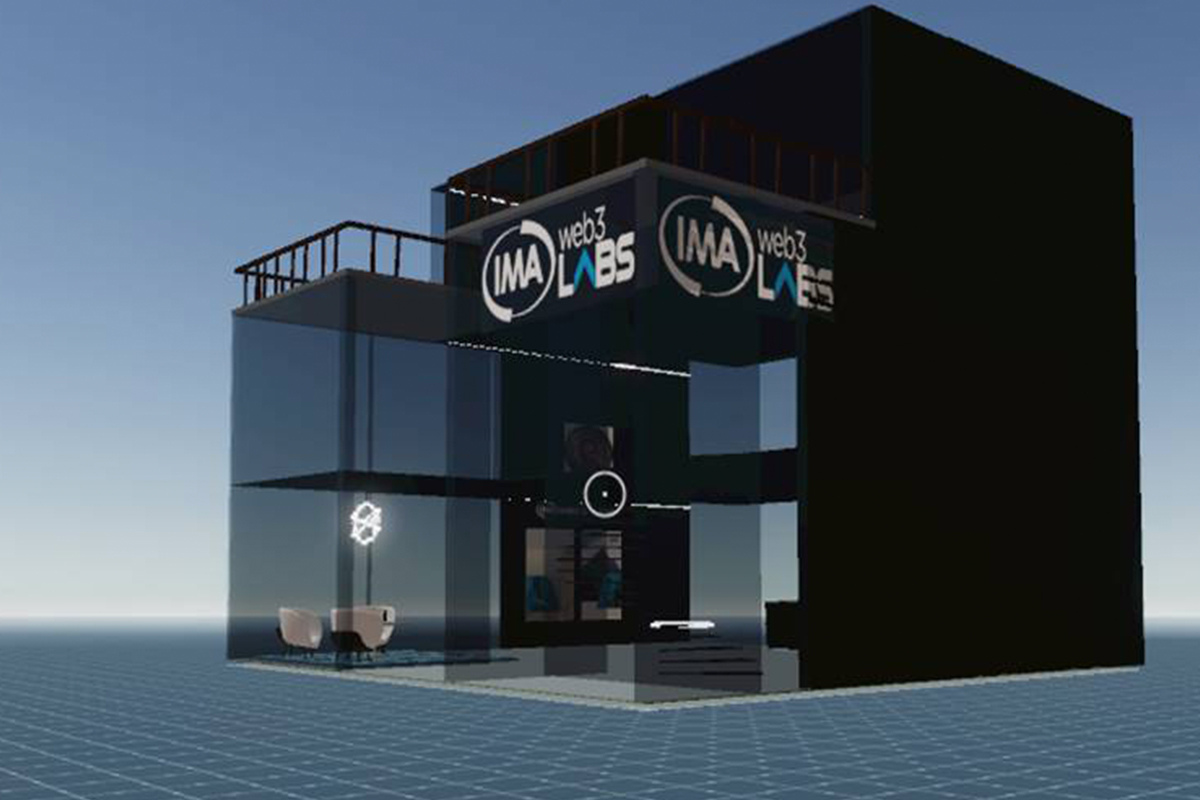

The US based IMA Financial Group today announced it was opening a metaverse insurance and risk management research and development facility.

Based in the Decentraland virtual reality platform, the company is setting up its IMA Web3Labs to explore market risk and insurance strategies specific to the metaverse.

The insurance broker is looking to assess what products and risk management services it can offer to clients who are investing in blockchain technology.

Head of IMA Investments Paul Washington said: “Web3Labs allows us to explore the risks associated with digital and meta assets from within the metaverse, so we can better prepare our clients to manage such risks.

“Our investment in IMA Web3Labs will also enable IMA to explore the infinite applications of blockchain technology to best understand how it might fundamentally shift the landscape of the $1trillion commercial insurance industry.”

The boom in the trade of NFTs – one of a kind digital assets that can come in the form of everything from art to virtual property – was largely behind the strategic shift according to IMA.

In 2021 $20billion worth of the tokens were sold, with total market value for NFTs now standing at more than $40billion.

Currently no one offers insurance for the unique assets.

However, just like with physical goods, NFTs are at risk.

Last month a scam saw $1.7million worth of tokens stolen from OpenSea, the leading marketplace of sales of NFTs.

Scores of assets were stolen in the complex scheme that impacted dozens of people.

Justin Jacobs, architect of IMA Web3Labs, said: “Society is at an inflection point, proven out by the popularity of meta-platforms.

“We need the ability to swiftly test, learn and adjust in a meta-native environment so we can build strategies and products that manage risks beyond the confines of the metaverse.”

Insurance is just the latest financial services sector to move into the Web3.0 space.

In January metaverse developer TerraZero began offering mortgages for digital land.

It is offering loans secured against the value of land for those looking to make purchases.

Metrovacesa, an estate agent with more than 100 years experience in Spain, has also opened an office in Decentraland, looking to let potential buyers of yet-to-be-built physical properties have a tour of the plot.

Meanwhile, last month JPMorgan became the first bank to enter the metaverse after opening a lounge in Decentraland.

Follow 24/7 Crypto on Twitter for the latest news and developments as they happen

What happened last week in the metaverse? Find out HERE.